Thanks to machine learning and artificial intelligence, finance leaders can streamline processes like invoice capture, reconciliation, and payments with little to no manual intervention.

According to Gartner, 85% of finance teams are undergoing finance transformation. But how do finance leaders achieve seamless, streamlined AP processes?

With a clear vision for digital transformation, finance leaders can:

- Identify a fit for the organization's unique needs

- Prioritize digital investment

- Achieve internal buy-in

- Increase digital usage

- Capture ROI and maximize financial goals

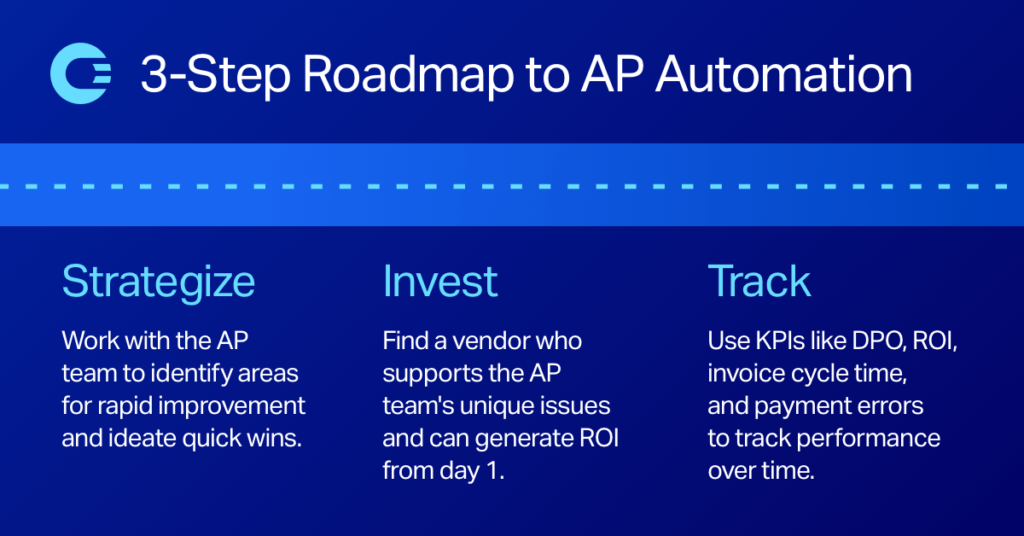

Here are 3 Steps Finance Leaders Can Take to Jumpstart their AP Automation Project:

Step 1: Strategize the AP Automation Roadmap

Start by connecting with accounts payable specialists and other internal stakeholders who the technology upgrade will impact.

Working collaboratively with other internal stakeholders will identify gaps that cause the AP team issues. For instance, the team may have difficulties reconciling invoices which causes them to miss payment deadlines.

Once the problem is identified, define improvement for the issue. In this case, the challenge could be caused by a lack of uniformity across the invoices they receive. How can automation help streamline auditing and accelerate approval timelines?

Defining all critical aspects of the process, including timelines, is crucial. Moreover, to drive internal acceptance and adoption of new tools all stakeholders uphold different responsibilities and be accountable to deadlines.

Once team expectations are in place, the next phase includes researching which automation tool will work best for your organization's unique processes.

Step 2: Prioritize Finding the Right AP Automation Vendor

Although investing in automation is a top priority for finance leaders in 2022, the question of which AP automation vendor to choose is tricky.

Review all options and monitor the quality of customer service you receive during the demo phase. A good vendor is invested from the beginning and will ask questions specific to your issues.

Here are some ways you can set expectations for automation software:

- How quickly are cash flow returns provided?

- Is there real-time discrepancy and duplicate identification?

- Is real-time spend data generated? Are executive dashboards offered?

- What is the support functionality for dispute management and tracking?

- What BI tools does the system work with? Will the software require unanticipated internal upgrades?

- What is the onboarding process? Are there fees for service and support?

- Are vendors required to set up portals?

- What is the IT team's scope of work?

For instance, here is an example of a positive vendor experience:

"From the beginning of the process, OpenEnvoy stood out because, unlike other vendors, they showed our team a personalized presentation during the buying process. They listened to our concerns and listed tactics on how they could solve our unique challenges.

They also performed a live demo, spending time with my team going through examples of our processes. The demo showcased the software's potential and made us feel comfortable that we were making the right investment decision", says Matt Cohen, VP of Finance at Bliss Point Media.

Your technology vendor should be confident in solving your unique problems before you agree to invest. Once you find a provider who can deliver results, it is time to take your AP automation journey into action.

Step 3: Track progress and pivot when necessary

In addition to collaborative project management and support from technology vendors, implementing new a tool requires a multiphase onboarding process:

- Discovery: Dive deeply into the AP processes with your tech vendor to discover gaps and potential failure points.

- Training: Expect one-on-one guidance and support through office hours, training, and product workshops.

- Automation: Work alongside IT to develop a scope of work that ensures fully customized automation after the technology is live.

- Feedback: Consistent and open communication is imperative. Moreover, your vendor should seek continual feedback to support your team's evolving needs.

Measuring success

Finally, after the automation tool is live, finance leaders must measure against onboarding objectives, and KPIs set at the roadmap's development. Some ways to determine efficiency in your payables processes are by tracking metrics like DPO, ROI, invoice cycle time, and payment errors to track performance over time.

Modern finance teams know that digitization is the first step to digital transformation. Accurate and efficient AP processes are the baseline for a competitive finance function. With the power of automation, accounts payable professionals spend less time on manual work and disputing overpayments, and more time delivering value required by a next-gen business world.

Get your finance team working faster with a flexible technology provider. Schedule a demo with an OpenEnvoy expert today, visit https://openenvoy.com/contact-us/.