Accounting and finance teams rely on proper general ledger (GL) coding to organize and understand spend. OpenEnvoy’s GL Accounts feature helps AP teams maintain accurate and consistent GL coding throughout their payables processes.

What finance teams can expect with OpenEnvoy’s GL Accounts:

- Utilize their unique GL coding in OpenEnvoy to ensure all information is correctly synced back into their ERP tools.

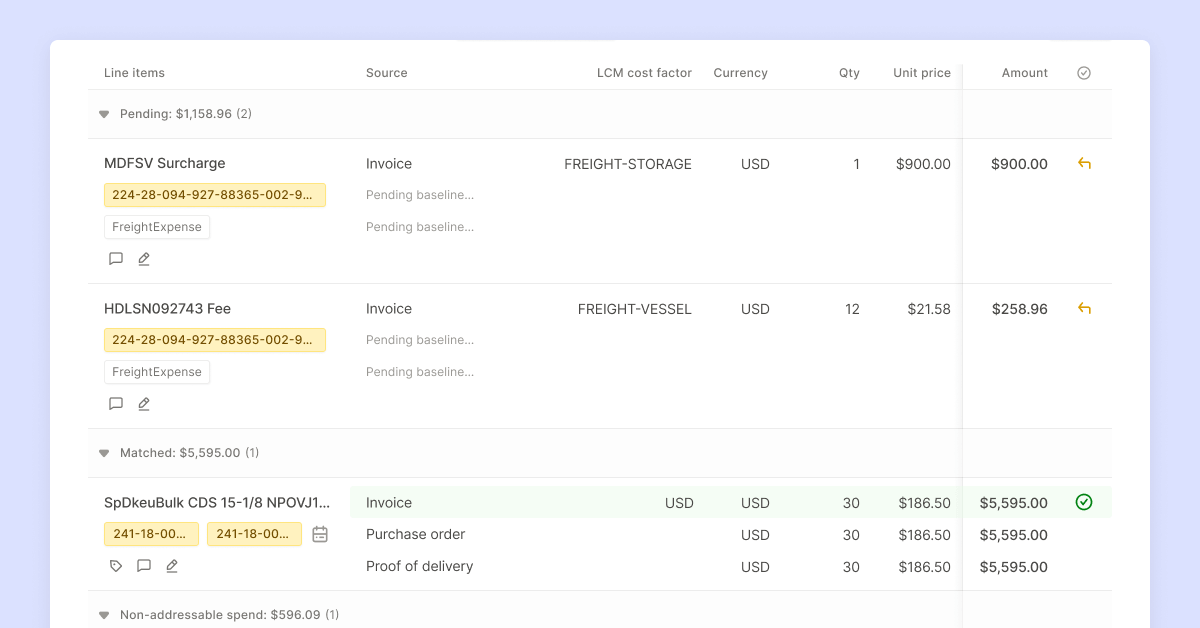

- Assign GL Accounts at the line-item level to categorize individual items within a single invoice.

- Create rules for specific GL codes to automate approvals, discrepancy thresholds, and spending limits.

The benefits of GL Accounts for finance teams:

- Maintain accurate categorization and coding of expenses between OpenEnvoy and ERP tools.

- Increase organization as teams can categorize expenses at the line item level of an invoice, making it easier to monitor recurring charges over time.

- Leverage easy-to-use analytics tools for greater spend visibility. View spend by GL account to track spend at a granular level.

How OpenEnvoy’s GL Accounts work:

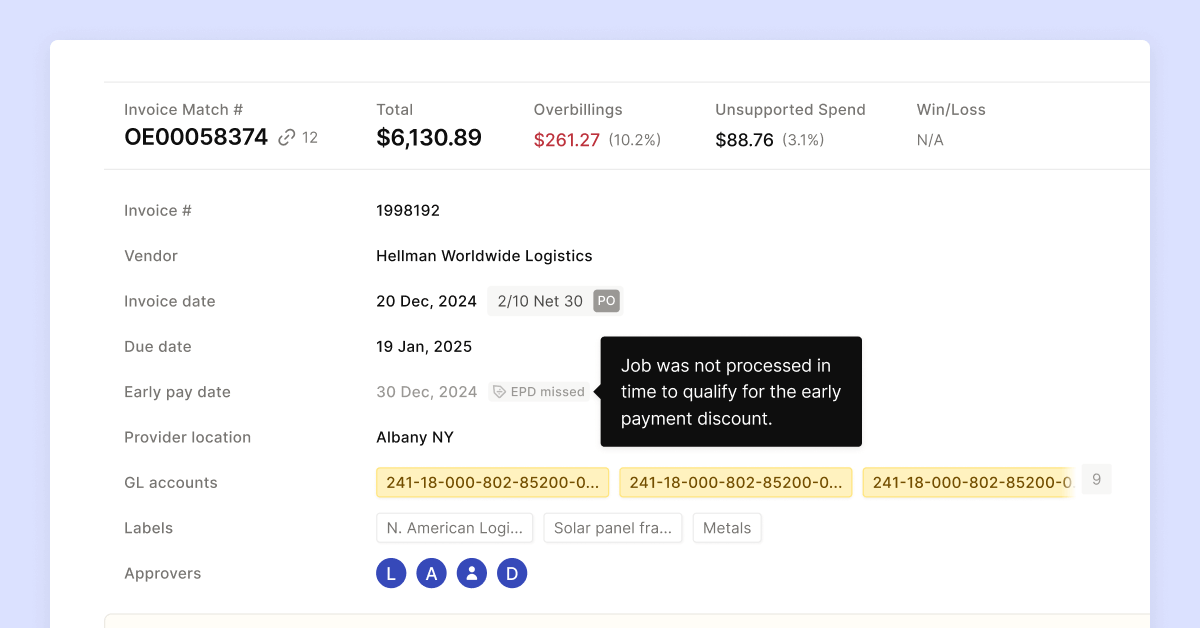

OpenEnvoy automatically applies GL codes to the invoice according to rules created in-app by the accounting team. The expense then maintains accurate coding throughout the OK-to-pay process. GL codes can also be added manually by navigating to a job and editing a line item in the Match Details table or by clicking into the GL Accounts field at the top of the page.

OpenEnvoy enables finance teams of all sizes with visibility, automation, and cash flow solutions. To learn more about how OpenEnvoy can help you prevent wasted spend, visit https://www.openenvoy.com to connect with an expert.